Affording Veterinary Care

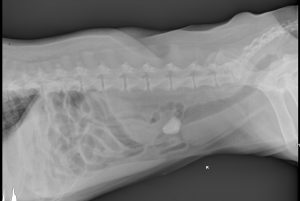

Today was a busy day. From the first dog with a sudden and severe ear infection, to the cat with continued vomiting after an overnight stay at the emergency clinic, to the dog that had mammary tumors, a bloated abdomen, and bloody urine, it seemed every patient needed lab work, x-rays, and multiple treatments. Not surprisingly, these tests and treatments were not cheap. And every owner, while not denying their pet the best care possible, was concerned about the cost.

I confess, I hate talking about money with owners. I want to make diagnostic and treatment plans based on practicing the best medicine I know how, without regard to cost. I know that is not realistic in today’s world. We are all on budgets.  But I feel I have to recommend the “gold standard” first, before the price tag makes us cut corners and potentially not do the absolute best for the pet. Not providing the best care is not really OK with me or my owners, but sometimes it is a sad reality.

But I feel I have to recommend the “gold standard” first, before the price tag makes us cut corners and potentially not do the absolute best for the pet. Not providing the best care is not really OK with me or my owners, but sometimes it is a sad reality.

Is there an alternative? Running a business (which is what a veterinary hospital is, after all) requires we charge for our time, services, and products. Medication costs continue to rise. Support staff is expensive, and very necessary to quality patient care. Equipment care, new technology, continuing education, and keeping the lights on mean we cannot give away services. How can owners be in a position to choose the care they want with financial freedom? How can veterinarians not be put in the position of being told by distraught owners that, “Vets are only in it for the money.” Or, “You don’t care about animals or you would help my dog for free.”

One solution to this problem are companies such as Care Credit, which offer a credit card for health care services, both human and animal. In many cases there is an interest free payment period. This program is helpful if you have a good credit score. Approval takes just a few minutes, which is ideal in an emergency situation. However, those whose credit scores are lower may not be eligible or may need a co-signer. Interest rates after the grace period can be high.

I used to be opposed to pet insurance. I thought it too costly, lacking coverage for what was necessary, emphasizing coverage for wellness plans that were unnecessary, and did I say too expensive? Well, I’m eating those words now, because I have seen pet insurance saving lives and enabling owners to provide care that was life changing. I am going on record encouraging owners to get pet insurance!

My opinion was first swayed by a friend’s dog, who appeared to be suffering from degenerative myelopathy, a progressive neurologic disease which leads to paralysis. My friend pursued consultation with specialists, advanced testing, and a variety of treatment options. The costs were huge, but her dog responded well to treatment, exceeding all expectations of her diagnosis. The only reason this was possible was the thousands of dollars of coverage from the pet insurance company. Another friend’s dog had chronic ear, skin, and thyroid problems. Ninety percent of the costs of care were covered by insurance, again amounting to thousands of dollars.

My opinion was first swayed by a friend’s dog, who appeared to be suffering from degenerative myelopathy, a progressive neurologic disease which leads to paralysis. My friend pursued consultation with specialists, advanced testing, and a variety of treatment options. The costs were huge, but her dog responded well to treatment, exceeding all expectations of her diagnosis. The only reason this was possible was the thousands of dollars of coverage from the pet insurance company. Another friend’s dog had chronic ear, skin, and thyroid problems. Ninety percent of the costs of care were covered by insurance, again amounting to thousands of dollars.

In my work at the hospital, one of the most common things I diagnose are cruciate ligament injuries. You may have heard them called ACL tears. They are very common in bigger dogs such as Labradors and Goldens, and very active dogs. Short legged breeds can also suffer this injury, sometimes in conjunction with a dislocated kneecap. Treatment involves surgery, and should also include physical rehabilitation. The cost involved varies, but typically starts around $3000, and could exceed $6000 in a complicated case. The difference between paying out of pocket and having 80-90% of the expense covered by insurance is huge!

So what are the four key things to look for in choosing insurance?

What is covered – Most important is coverage for illness and injury. Read the fine print on wellness coverage — sometimes this is not the best value. Be sure that any specific type of care you may want is covered, including holistic care, rehabilitation, advanced dental care, etc. Be sure conditions that your dog’s breed is predisposed to are covered. Look for a no lifetime limit on coverage, especially if you are starting insurance when your dog is a puppy.

Deductible – I think the option to choose your deductible and therefore premium is a huge benefit. Annual deductibles are often money savers compared to per condition deductibles.

Excluded conditions – Obviously, pre-existing conditions are not going to be covered. Some companies will exclude breed specific conditions, certain therapies, a second cruciate tear, and some medications or procedures. Read the fine print.

Waiting period – Most companies will have a waiting period before the policy goes into effect. For some problems, that waiting period could be up to a year. For most conditions, it will be a matter of days.

I have reviewed several companies, and found one to be superior, Healthy Paws. Prompt payment, solid coverage including holistic and alternative care, and a good track record in complex and expensive cases make me a fan of this company. Using the link provided will not only support the Healthy Dog Workshop site, it will save you 10%!

I encourage you to explore pet insurance options while your dog is young, or when he first comes into your home. This will ensure the lowest rates, as potentially avoiding a pre-existing condition. Immediate insurance activation is vital for newly adopted shelter dogs, who may be incubating a serious disease for which you want coverage. Be proactive — it may save your best friend and thousands of dollars in the long run.